The availability of accurate information on both the financial position and the future evolution of cash flows has become a requirement that can no longer be postponed for the Finance Department. The performance of the function is then more and more under pressure with increased risk management needs both in the market and in the counterparty, but also with an increasingly compelling need to fight potential fraud, especially in the field of payment management.

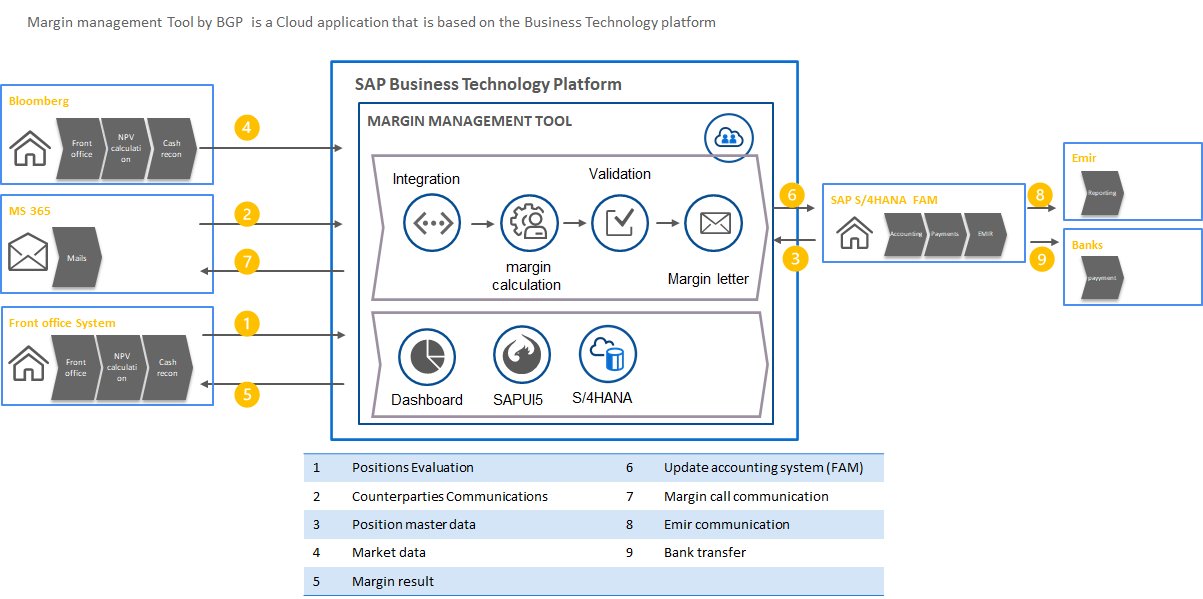

Accompanying companies in the processes of skills and systems in the Treasury area (TMS) development , with particular attention to the aspects of activities and resources centralization also international, is the target and the commitment of BGP.

BGP has organized itself identifying and developing highly integrated expertise and services. Services that cover the entire life cycle of the development initiative: from the initial study and design to the realization and even then taking charge of the management and maintenance of the implemented solutions.

Within Treasury BGP aligns focused skills and specialist solutions: Cash Management, Treasury Management, Financial Risk Management, Financial Planning & Reporting, Trade Finance with a particular focus on Reverse Factoring. The solutions are clearly consistent with the opportunities offered by the evolution of the technologies: Real-Time and usable also through Mobile and Cloud platforms.

Snapshot of the health of treasury processes.

Costs, timing and roadmap for digitization.

Best-practices to implement the best scenario for your reality.

TMS industry adoption and appetite for new technology is just one reason why digitization has changed the way corporate treasury functions operate. Here are the main drivers:

Cash flow management based on timely data for better decision-making strategy in cash deployment.

Tools to centralize liquidity, with cash pooling mechanisms, to minimize banking costs, save on connectivity, and maximize volumes.

Easier and more immediate forecasting management with real-time, up-to-date and truthful data from secure sources and the result of a well-defined consumptive process.

Technologies derived from data science to predict treasury availability with greater speed, control and reliability.

Simplified bank management by ensuring standardization and intelligent management of incoming and outgoing flows.

Comprehensive analysis of financial flows by obtaining real-time data and information for rapid action and high transparency.

All this allows us to effectively operate for the implementation of the Payment Factory and the Treasury Center, to optimize not only financial resources and ensure the coverage of financial risks.

Furthermore, BGP with its multi-year partnerships is able to integrate a large number of complementary services to TMS solutions: Market Data Providers, Dealing Platforms, Trade Repository, Bank Connection.